A conservative activist slapped the company owned by billionaire investor Warren Buffett with an SEC complaint after he was bullied and arrested for public comments questioning Buffett’s backing of Bill Gates and his connection to the late pedophile and sex trafficker Jeffrey Epstein.

According to the Daily Signal, Peter Flaherty, chairman of the National Legal and Policy Center, filed the complaint on Tuesday with the Securities and Exchange Commission, asking for the agency to sanction Buffett’s company, Berkshire Hathaway, for manhandling him and, by extension, mistreating other stockholders who own a piece of Buffett’s firm.

“The point of the complaint is to ask for relief from the SEC,” Flaherty told The Daily Signal on Tuesday. “We are asking for Berkshire Hathaway to cease and desist from doing this in future shareholder meetings, to acknowledge their actions constitute a violation of the rules, and order that my full remarks be posted on the website.”

Read: Democratic Megadonor, Linked To Jeffrey Epstein, Gives $250,000 To Nikki Haley Super PAC

The controversy stems from May, when Flaherty, representing his nonprofit group, which owns stock in Berkshire Hathaway, spoke at the annual shareholders’ meeting. He was on the list of those approved for an opportunity to address Buffett.

Flaherty spoke in favor of forcing Buffett to give up being either CEO or board chairman of Berkshire Hathaway, Flaherty argued allowing Buffett to hold both posts made the company, and its shareholders, captive to Buffett’s leftist political activities.

Those activities included Buffett donating billions to the Bill and Melinda Gates Foundation.

When given his three minutes to speak to Buffett at the meeting, Flaherty argued that the Gates Foundation supports Critical Race Theory, champions transgender ideology, funds a group that argues for defunding the police, and defends China’s draconian COVID-19 policies.

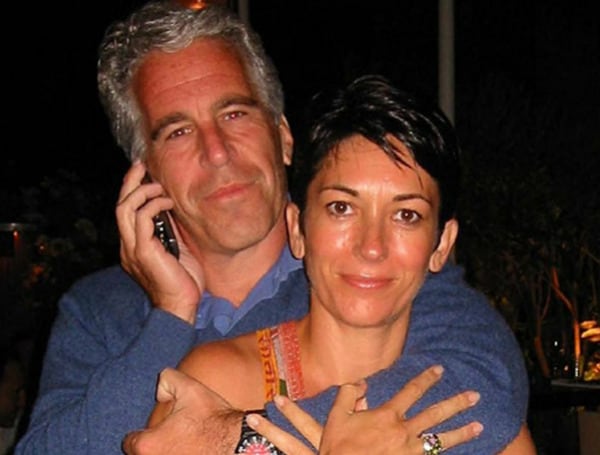

He also pointed out that Bill Gates traveled with Epstein “many times” after Epstein was convicted of sex crimes, most notably trafficking underage girls to wealthy and powerful friends.

Barely halfway into his comments, Flaherty said his mic was cut and he was approached by security guards, who requested help from a police officer.

Buffett did nothing to intervene on his behalf, and Flaherty was eventually arrested and charged with criminal trespassing. He was freed after three hours in police custody.

Flaherty in his complaint noted that even the cops thought his arrest was “unwarranted.”

The beef that he is taking to the SEC is that Buffett “unlawfully and arbitrarily” violated the rights of shareholders under SEC rules to question how the companies they own a piece of are managed.

“The almost instantaneous silencing and arrest of Mr. Flaherty at the very mention of Epstein obviously struck a nerve with the public that transcends political ideology, underscoring the widely held belief that the rich and powerful play by a different set of rules than ordinary citizens,” Flaherty argues in his SEC complaint.

Read: Florida Gov. DeSantis, As President, Pledges To Reveal Jeffrey Epstein’s Secrets Held By The Feds

“While the rich and powerful may indeed enjoy immunity from society’s rules and norms, it does not exempt them from legal requirements for annual shareholder meetings for public companies.”

“The whole point of the shareholder proposal process is to allow shareholders critical of management an avenue to change corporate policy,” Flaherty added.

“To simply silence and arrest a shareholder who disagrees with management stands the whole concept of protecting shareholders’ rights on its head.”

“Berkshire and Mr. Buffett’s actions are an ominous precedent for the rights of shareholders that cannot be allowed to stand,” Flaherty concluded. “We believe that the silencing and arrest of a shareholder during their presentation on behalf of their proposal at the annual meeting of a public company in the United States is unprecedented, should be sanctioned, and should not be allowed to be repeated.”

Android Users, Click To Download The Free Press App And Never Miss A Story. Follow Us On Facebook and Twitter. Sign up for our free newsletter.

We can’t do this without your help. Visit our GiveSendGo page and donate any dollar amount; every penny helps.