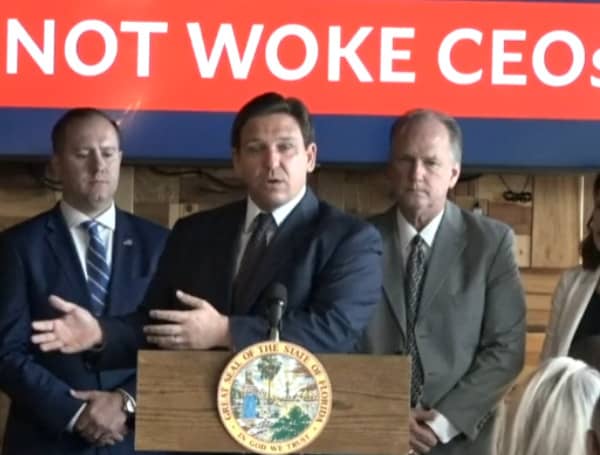

TFP File Photo The Florida Senate on Wednesday gave final approval to a bill that would prohibit investment strategies that Gov. Ron DeSantis has

The Florida Senate on Wednesday gave final approval to a bill that would prohibit investment strategies that Gov. Ron DeSantis has deemed “woke,” sending the issue to his desk.

The Republican-controlled Senate voted 28-12 along party lines to prohibit consideration of “environmental, social and governance” standards in investing government money. The bill (HB 3), a priority of House Speaker Paul Renner, R-Palm Coast, passed the House last month.

The bill also would prohibit financial institutions from engaging in any “unsafe and unsound practice” or applying a “social credit score” when offering services. They wouldn’t be able to deny or cancel services to people based on political opinions, affiliation or speech.

In the news: Bill Targeting Florida Drag Shows That Allow Children, Heading To Gov. DeSantis

The measure would expand on a directive issued last year by DeSantis and state Cabinet members requiring investment decisions in the Florida Retirement System Defined Benefit Plan to prioritize the highest returns without consideration of the standards known as “ESG.”

Republicans across the country have criticized ESG as an “agenda-driven” effort against investments in fossil fuels, arms manufacturers and prisons.

Senate bill sponsor Erin Grall, R-Vero Beach, said the measure would require fund managers to “maximize financial returns.”

During questioning Tuesday, Grall said the bill would require state- and local-government investment decisions to be based “solely on pecuniary factors.” She called ESG “vague in how it’s applied” and said investment practices shouldn’t “sacrifice returns on investment for the subjective priorities and political agendas of large corporations, institutional investors and money managers.”

“Our decisions should be agnostic of the politics, social (and) ideological, and we should be making the best decisions based on the return for Floridians,” Grall added.

In the news: Board Expands Florida “Parental Rights In Education” Law

The bill wouldn’t stop fund managers from investing in companies that use such standards. But the fund managers wouldn’t be able to base investment decisions on issues such as climate change and social diversity.

Critics contend the proposal would cost the state money and hinder investment decision-making.

Kansas lawmakers this year dropped a tougher version of anti-ESG rules after the head of the state pension system warned the changes could result in $3.6 billion in losses over 10 years. Indiana lawmakers also rewrote ESG directives after an initial proposal was projected to cost the pension system $6.7 billion over the next decade.

Legislative analysis of the Florida proposal didn’t include a projection of economic impacts.

Sen. Tina Polsky, D-Boca Raton, said studies have shown the change could cost the state $97 million to $300 million in additional interest charges on municipal bonds.

In the news: Alimony Overhaul Clears Florida Senate

Sen. Lori Berman, D-Boca Raton, questioned why the state would want to cut itself off from companies like BlackRock, which she said has made “tremendous returns” through investments using ESG standards.

In December, state Chief Financial Officer Jimmy Patronis announced that Florida would pull $2 billion from BlackRock, the largest asset-management firm in the world, because of ESG practices.

Sen. Jason Pizzo, D-Hollywood, called the proposal “incredibly laughable,” saying he knows people the bill targets.

“If they pulled out while we’re trying to be punitive to them … we would be in a really bad financial condition,” Pizzo said.

“Remember, the people that we’re trying to attack are not in the business of losing money and giving it away,” Pizzo added.

When the legislation was rolled out in February, DeSantis’ office called the proposals a way to “protect Floridians from the woke environmental, social, and corporate governance movement that continues to proliferate throughout the financial sector.”

Android Users, Click To Download The Free Press App And Never Miss A Story. Follow Us On Facebook and Twitter. Signup for our free newsletter.

We can’t do this without your help; visit our GiveSendGo page and donate any dollar amount; every penny helps.